Blockchain faces a scalability problem due to limited transaction throughput, slow confirmation times, and resource-intensive consensus mechanisms. As user bases grow, demand for transactions increases, causing congestion and hindering the widespread adoption of blockchain technology.

Solving scalability is crucial for enhancing user experience, supporting real-world applications, and ensuring the competitiveness of blockchain networks in a rapidly expanding industry.

Here, I’ll explore the main blockchain scalability solutions available in 2023, dividing them into on-chain and off-chain solutions.

5 On-Chain Scalability Solutions

On-chain scalability solutions, also known as ‘first-layer scalability solutions,’ refer to scalability improvements made directly on the blockchain’s base layer, and include methods like:

These solutions typically change the underlying consensus mechanism, data processing methods, or block structure. Regardless, the goal is to boost the transaction throughput of the L1 chain.

1. Sharding

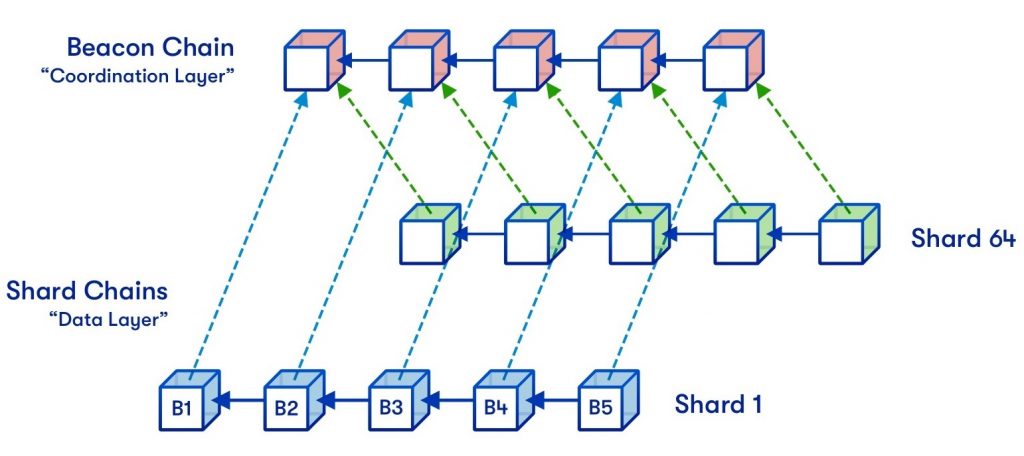

Sharding divides the blockchain network into smaller parts called ‘shards.’ Each shard works as an independent blockchain, meaning it can process a subset of transactions autonomously. A single main chain is tasked with keeping all shards synced.

For example, Ethereum has been adopting sharding since December 2020, when it launched the Beacon Chain. By parallelizing data processing, the network’s capacity increases substantially. However, sharding makes the blockchain consensus more complex and introduces new risks. For these reasons, Ethereum developers have postponed implementing sharding.

2. Consensus Algorithm Optimization

Consensus algorithm optimization is a broad term encompassing various improvements to the underlying consensus mechanism for scalability. Here are some examples:

- Pruning removes unnecessary data from the blockchain, such as old transaction information no longer needed for validation. It makes the blockchain more manageable by reducing its size.

- Parallelization allows the network to process transactions in parallel rather than sequentially, increasing throughput.

- Optimized signature schemes reduce the computational workload needed to validate a transaction, speeding up the consensus process and block confirmation.

For instance, Zircuit has pioneered decomposing circuits for parallel transaction processing. Some blockchains that have used pruning to boost performance include VMware Blockchain, Monero, and Aptos.

In some cases, consensus algorithm optimization leads to soft or hard forks.

3. Soft and Hard Forking

Soft and hard forks often implement significant changes to the blockchain protocol, such as introducing new features, fixing security vulnerabilities, or changing the consensus algorithm.

A hard fork is a major structural or fundamental change to the blockchain’s protocol (e.g., increasing block size or reducing block time). It requires all nodes to upgrade to the new version, which is often contentious and can cause network splits.

Conversely, a soft fork is backward-compatible, meaning nodes that haven’t upgraded can still interact with the upgraded ones.

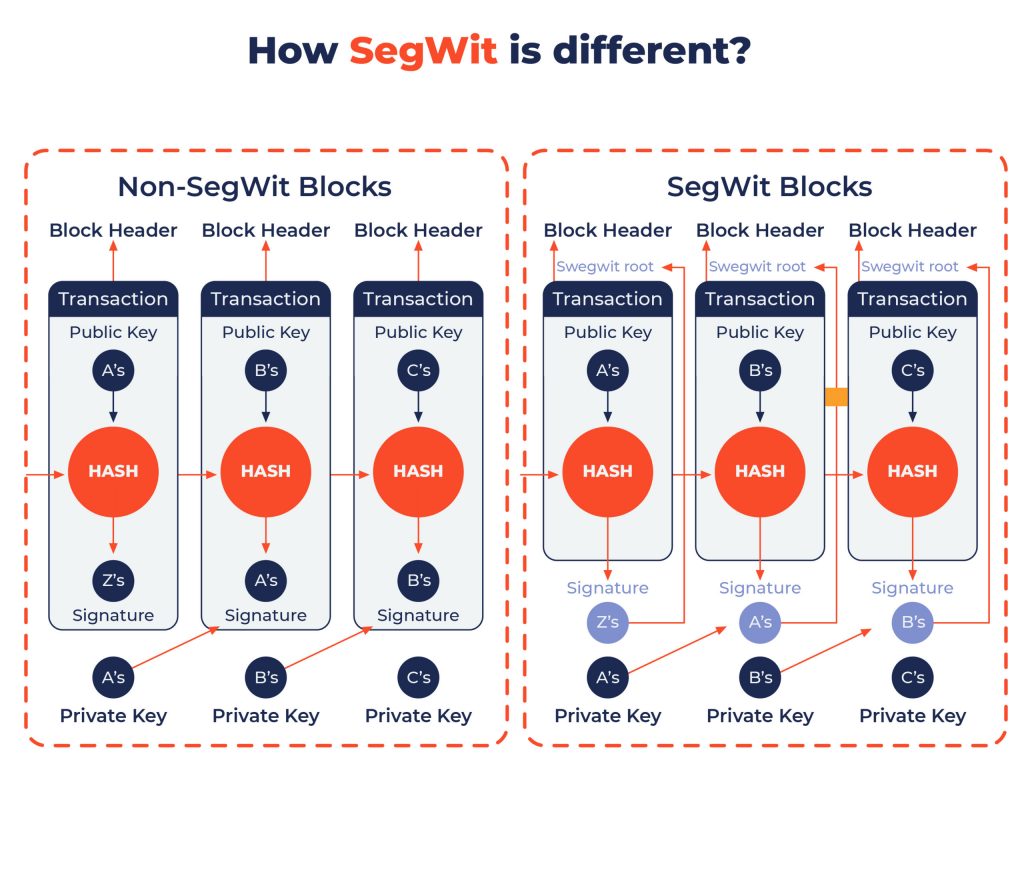

The most notable soft and hard forks are Segregated Witness (SegWit) and Bitcoin Cash, respectively.

SegWit, a protocol change to the Bitcoin network, introduced a crucial improvement by separating transaction signatures from data. This separation boosted scalability by reducing the size of each transaction, meaning more transactions could be included in a block.

While it was technically a soft fork, some Bitcoin developers started a hard fork to avoid the protocol update. The split resulted in a whole new network — Bitcoin Cash.

4. Dynamic Block Size

Some blockchains adjust block size dynamically according to network congestion, accommodating more transactions during busy periods. This allows them to manage high activity efficiently.

However, excessively large blocks pose centralization concerns by favoring nodes with greater resources. Striking a balance between achieving optimal scalability with dynamic block size without compromising decentralization and network stability is difficult.

Monero, a privacy-focused cryptocurrency, is the most successful and well-known example of a blockchain with a dynamic block size. Another example is Safex Cash.

5. State Rent

State rent is a mechanism implemented within the blockchain’s protocol that charges users ongoing fees for maintaining their data and smart contracts on the blockchain. This helps prevent indefinite storage, reducing network bloat and improving efficiency. In addition, it encourages responsible blockchain usage and ensures a more sustainable and scalable system.

The main objective of the Nervos blockchain, also known as Common Knowledge Base (CKB), is to reliably store and preserve users’ data and assets. It charges state rent to compensate miners for providing storage space and to ensure network scalability by discouraging the storage of unnecessary data.

6 Off-Chain Scalability Solutions

Off-chain scalability solutions aim to increase the transaction throughput of the base layer just like on-chain solutions. However, instead of making changes to the L1 chain, off-chain methods scale their capacity by processing transactions and smart contracts off the main chain.

Here are the off-chain scalability solutions I’ll explore below:

- Bridges and interoperability protocols

- Sidechains

- Layer 2 blockchains (L2s)

- State and payment channels

- Rollups

- Validium

A quick note before we start: The terms “off-chain scalability solutions” and “layer 2 blockchains” are sometimes used interchangeably, but they’re not synonymous (more on this later).

1. Bridges and Interoperability Protocols

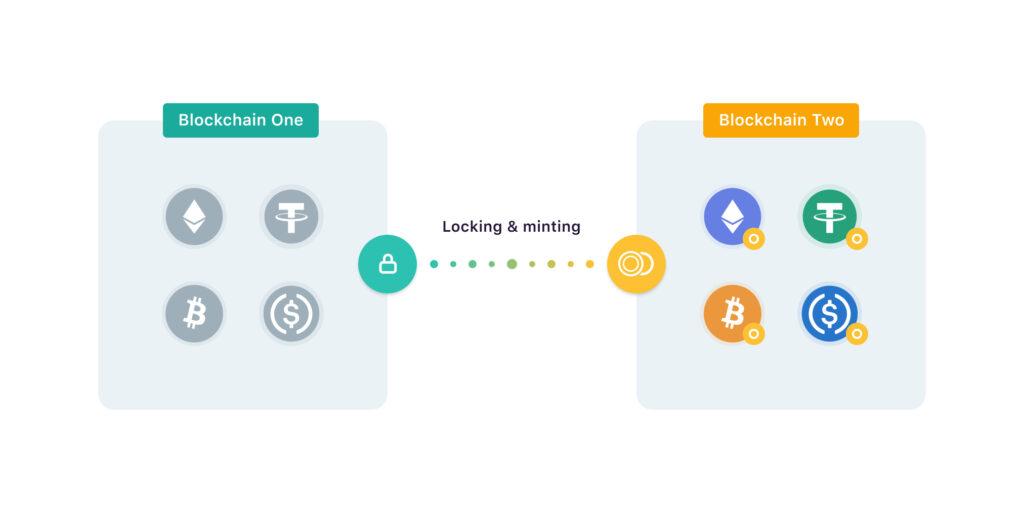

Bridges and interoperability protocols aren’t scalability solutions per se. However, they make different blockchains interoperable by facilitating cross-chain transactions and communication. This allows for the distribution of the load across multiple interconnected chains, contributing to scalability.

Essentially, bridges use smart contracts deployed on the mainchain and a side chain or layer 2 to control the bridging of assets and data between them. Assets aren’t physically moved across chains, though. The bridging mechanism typically involves burning or locking and minting for transferring value.

Bridges can be used to connect blockchain layers or separate blockchains. For example, you can use a bridge to move funds from Ethereum (L1) to Arbitrum (L2 built on Ethereum) or to transfer them from Ethereum (L1) to Solana (another L1).

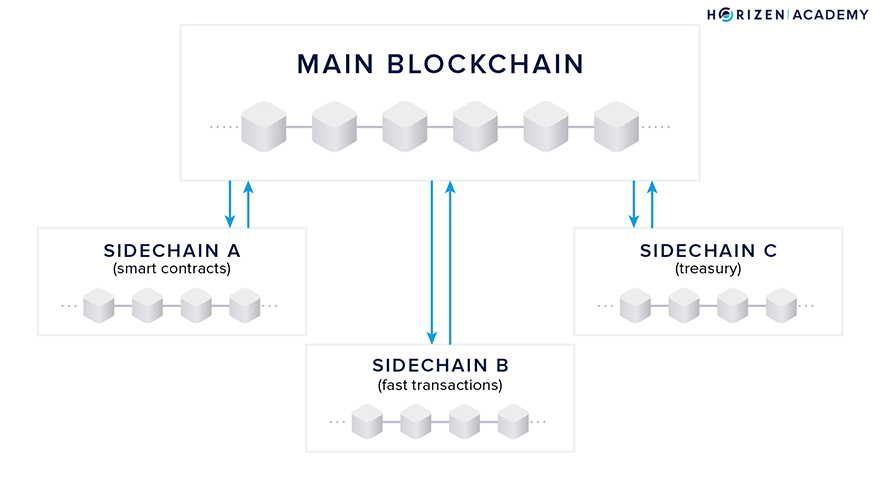

2. Sidechains

A sidechain is a separate blockchain that runs independently from the mainchain, using a two-way bridge for cross-chain communication. These chains can have radically different protocols, block parameters, consensus algorithms, and tokens, and are often optimized for specific use cases.

While they’re commonly geared towards efficient transaction processing, using sidechains involves trade-offs. They often sacrifice some measure of decentralization and security for high throughput, add complexity, and require a lot of investment and effort to set up.

Sidechains are independent but typically pegged to the main chain. To communicate, assets are locked in the main chain, and an equivalent amount is unlocked in the sidechain (and vice-versa).

The mainchain can be connected to several sidechains and be used as a relay network for inter-sidechain communication.

Here are some prominent sidechain examples:

- Gnosis Chain was one of the first-ever Ethereum sidechains. Its main aim is to scale the mainchain through faster and cheaper transactions.

- The Liquid Network improves Bitcoin’s functionality with faster transactions and greater confidentiality.

- RootStock adds smart contract functionality to the Bitcoin network, allowing them to build dapps using Solidity.

Polygon is often referred to as a sidechain, but it evolved to feature layer 2 characteristics when it rebranded from Matic Network in 2021.

3. Layer 2 Blockchains

Layer 2 blockchains aren’t one solution, but a group of solutions. As mentioned, the terms “layer 2 blockchains” and “off-chain scalability solutions” are sometimes used interchangeably, but they’re not synonymous.

In essence, what makes layer 2s different from other off-chain methods, including sidechains, is that they derive their security from the layer 1 chain.

L2 scalability solutions include state channels, payment channels, optimistic rollups, and zero-knowledge rollups.

4. State and Payment Channels

Channels allow participants to carry out an unlimited number of instant, feeless transactions off-chain, while only submitting two on-chain transactions — one to open and another to close the channel. This facilitates extremely high transaction throughput at a low cost. It also reduces congestion, fees, and delays in the mainchain.

State channels are suitable for all types of transactions, including general-purpose computation. They are particularly useful for scenarios requiring frequent interactions between parties, like gaming or microtransactions.

Payment channels are a specific type of state channel for conducting fast and cost-effective micropayments directly between participants.

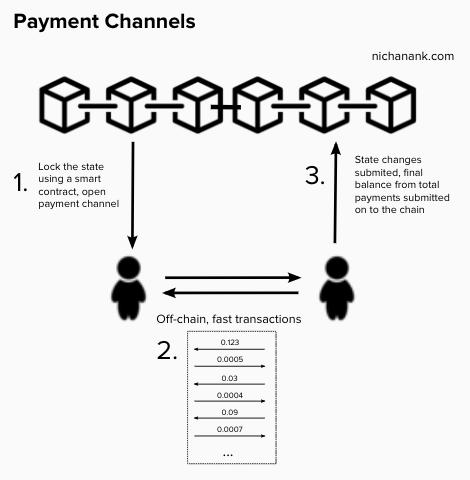

While there are some nuances specific to payment channels, the process of using a channel generally has three steps:

- Setting up the channel: Participants create a multi-signature wallet on the blockchain and lock a certain amount of cryptocurrency into it, establishing the initial state.

- Off-chain transactions: Participants conduct a series of off-chain transactions among themselves. These transactions are not broadcast to the blockchain but are instead signed by the involved parties.

- Closing the channel: When participants are done, they can close the channel by submitting the final state to the mainchain.

The two most notable channels are the Lightning Network for Bitcoin and the Raiden Network for Ethereum.

5. Optimistic and Zero-Knowledge Rollups

Rollups are built to increase transaction throughput and reduce costs for users. They’re called “rollups” because they roll up (i.e., bundle) a set of transactions, execute them on an off-chain virtual machine (VM), and submit a state update representing all batched transactions to a smart contract in L1.

The smart contract deployed on the mainchain connects the two layers and maintains the rollup state — it works as a bridge between the two layers.

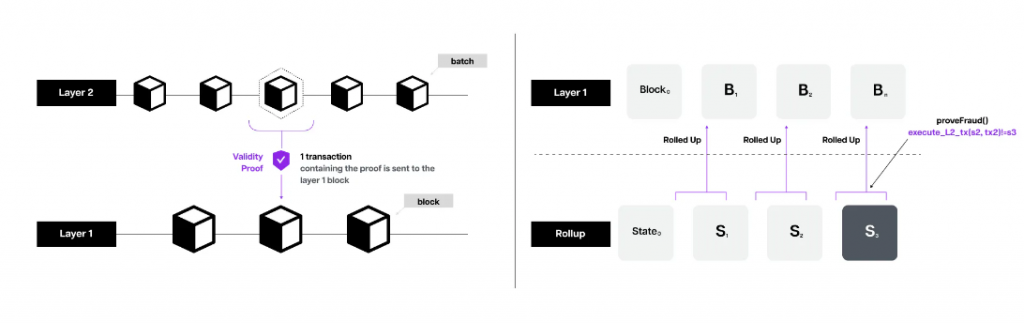

The main difference between optimistic and zero-knowledge (ZK) rollups is their security models.

- ZK-rollups only submit a summary of all transactions and a validity proof to finalize a batch of transactions. Once the smart contract verifies the validity proof, funds can be moved from L2 to L1 immediately.

- Optimistic rollups post all transaction data to the mainchain in batches and assume transactions are valid by default. This results in quick processing, but there’s a delay period for L2 to L1 withdrawals so that any participant can submit a fraud proof if they believe a transaction is invalid.

Rollups are one of the safest and most promising scaling solutions because they operate independently, but rely on the mainchain for data availability and transaction finality, deriving its security and decentralization.

ZK-rollup examples include zkSync, Starknet, and Polygon zkEVM. Arbitrum and Optimism are the most popular optimistic rollups. Zircuit is a pioneering hybrid architecture rollup, combining optimistic and ZK infrastructure.

6. Validium

Validium combines the benefits of rollups and state channels, creating a highly scalable, privacy-focused layer 2 solution. It executes transactions and stores data off-chain, substantially increasing throughput. So much so, that a single Validium chain can process over 9,000 transactions per second (and several chains can be run in parallel).

Like ZK-rollups, it submits validity proofs to a smart contract on the base layer to verify off-chain transactions and allows for speedy withdrawals. However, it doesn’t store transaction data on the base layer — this is the main difference between Validiums and ZK-rollups.

While this is one of the reasons Validiums offer such high transaction throughput, it introduces trade-offs. For instance, off-chain data can be withheld from users, freezing their funds in L2.

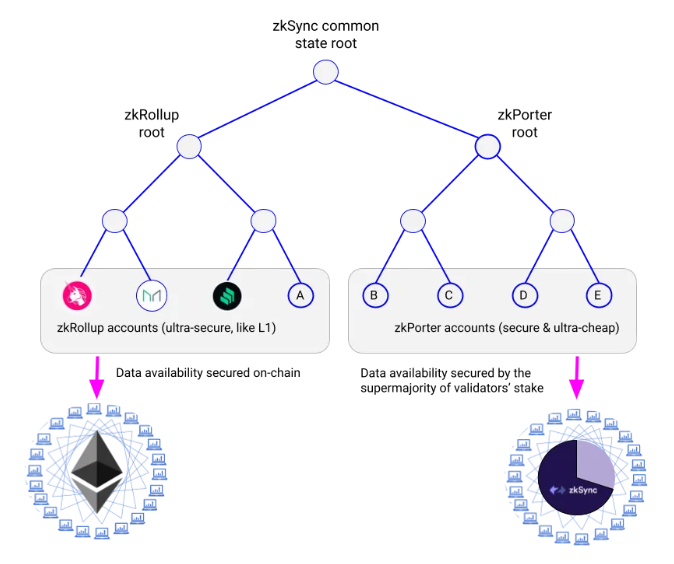

StarkWare’s StarkEx is a validity-proof-based scalability solution where you can choose to operate with ZK-rollup or Validium data availability. Another interesting example is Matter Lab’s zkSync. They sharded the network — one part works as a regular ZK-rollup and another, the zkPorter root, works as a Validium, where data availability is secured by the supermajority of the validator’s stake.

Closing Thoughts: Why Do We Need So Many Blockchain Scalability Solutions?

Diverse blockchain scalability solutions are essential for the mainstream adoption of blockchain and Web3 due to the varying needs of different use cases and user preferences. Each network and application has unique scalability challenges; that’s why no one-size-fits-all solution exists.

Having multiple solutions allows for flexibility in addressing specific scalability issues, suits diverse applications, meets the requirements of a global user base, and prevents single points of failure. This variety fosters innovation and competition, ultimately enhancing the overall efficiency, usability, and accessibility of blockchain and Web3 technologies.

In 2023, developers introduced numerous blockchain scalability solutions, including innovative hybrid architectures. Research breakthroughs have reignited interest in zero-knowledge rollups. 2024 promises excitement for the blockchain space, and I anticipate continued growth in the scalability ecosystem.